Get compliant

Fulfill the Corporate Transparency Act mandate with our support. We handle the submission of data regarding your business's owners or controllers to the Financial Crimes Enforcement Network (FinCEN).

As part of the Corporate Transparency Act, a new federal mandate requires that businesses file a Beneficial Ownership Information Report to avoid criminal and civil penalties. We can help you to file in a compliant and stress-free way.

Navigating a new law with civil and criminal penalties, such as imprisonment and fines, can be overwhelming. Our seamless and precise report filing eliminates concerns and ensures compliance effortlessly.

Fulfill the Corporate Transparency Act mandate with our support. We handle the submission of data regarding your business's owners or controllers to the Financial Crimes Enforcement Network (FinCEN).

Ease the burden of navigating a new federal law by using our swift and straightforward filing service. We guarantee compliance with all Corporate Transparency Act specifications.

Rest assured with our precise, compliant submission. We cover all FinCEN and law-required information, providing confirmation once the report is completed for added assurance.

Setup a new LLC from scratch with DeltaHub.

Migrate an existing LLC to DeltaHub.

You are required to file identifying information about the individuals who directly or indirectly own or control your company with the Financial Crimes Enforcement Network in order to satisfy requirements under the Corporate Transparency Act.

The Beneficial Ownership Information Reporting Rule went into effect Jan. 1, 2024, and it’s important to understand this new law given the severity of criminal and civil penalties for failure to file, which include imprisonment and fines.

Correctly reporting the required information about those who own or control your business is key to avoiding serious civil and criminal penalties. We can help you easily and accurately meet those requirements.

Answer a few simple questions about the individuals who own or control your business so your report is personalized and accurate.

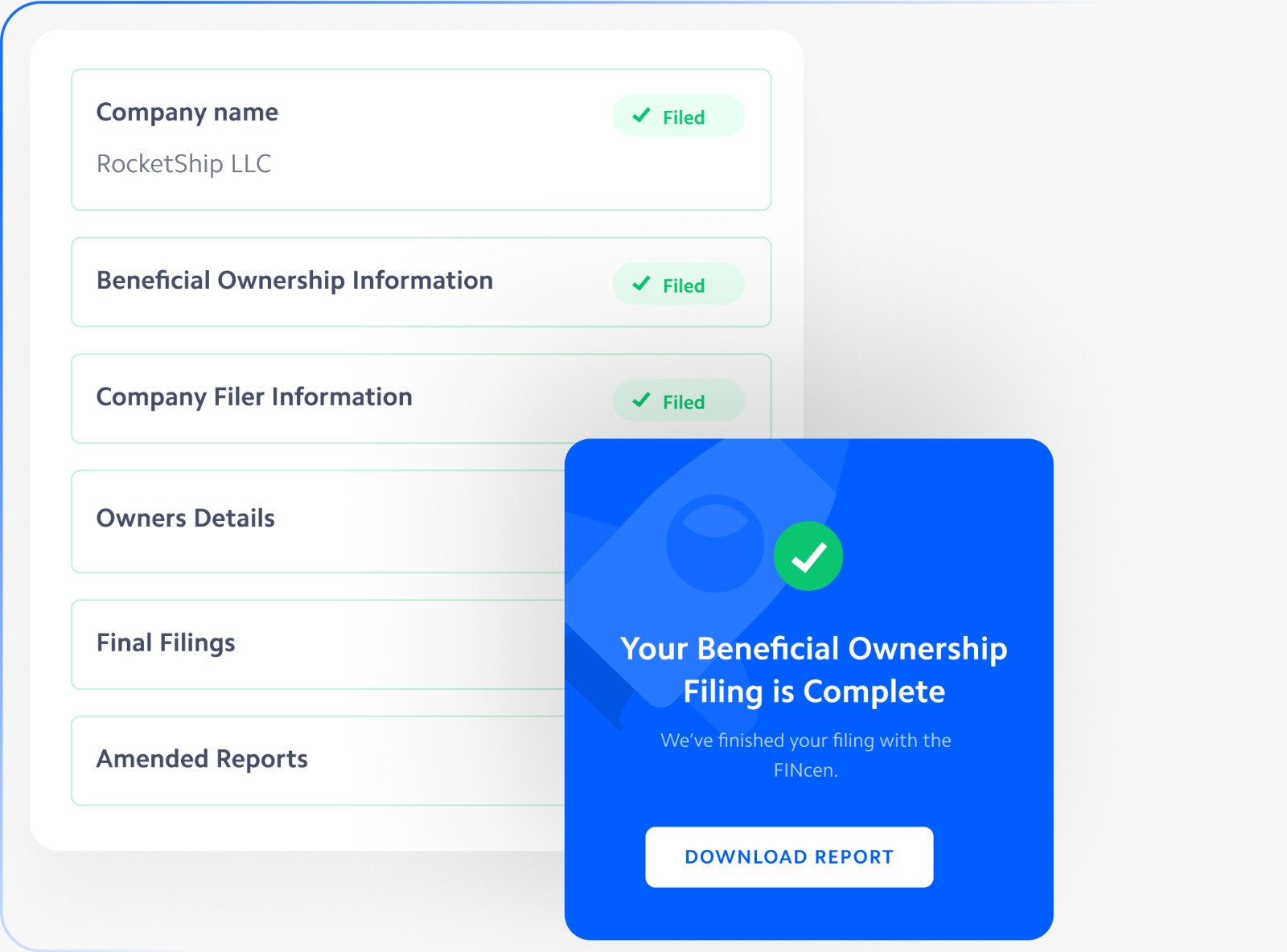

We’ll prepare a personalized report that satisfies the beneficial ownership information reporting requirement, and we’ll file it for you.

Once we file your personalized report with the Financial Crimes Enforcement Network (FinCEN), we’ll provide confirmation.

DeltaHub is excellent 🔥🔥 It was a totally succesful journey. They helped me with everything in starting my new business. I would give more than 5 stars. Only one thing i wish they downgrade the monthly maintenance price in the future cause it's a little bit high for the new business.

Love the experience. Got my business set up and all necessary details in about a month and I barely had to do anything. Definitely recommend!

I am absolutely blown away with the service received. Really well worth it, and reliable and trustworthy. Delivered in time, and sooner on most of the deliverables.

Definitely made everything easy! Simple streamlined process- Highly responsive- Great communication- All documents and information were provided in a timely manner.

DeltaHub delivered perfectly as promised and it was suuuper quick!! The whole formation phase took like 5-6 days and only the bank approval took like a week and a half but that wasn't on their end and it's expected! Can't recommend them enough!

Our overall experience with DeltaHub was great… From the beginning until the end of all processes we felt Start Global always next to us, supporting and advising us in all matters arising. We definitely advise Start Global for those who would like to set up a company in US. Thank you again…

Start Global is amazing! Their platform is very straightforward, very easy to use, and efficient. The team was very helpful and responded fast to all my questions. We have incorporated the company in just a few weeks, I'm super happy with the Start Global team! Thank you so much for your support! 100% recommend!

The process is comfortable and easy to understand. For me, the final point was customer support that replied fast and explain everything even not under their control. Looking forward to continuing work with the guys!

Instances of substantial control in Beneficial Ownership encompass:

Tax-exempt entities meet any of these criteria:

The criteria encompass:

Inactive entities, not required to report, must meet these criteria defined by the Financial Crimes Enforcement Network:

Exemptions from the beneficial owner definition under the Act cover: