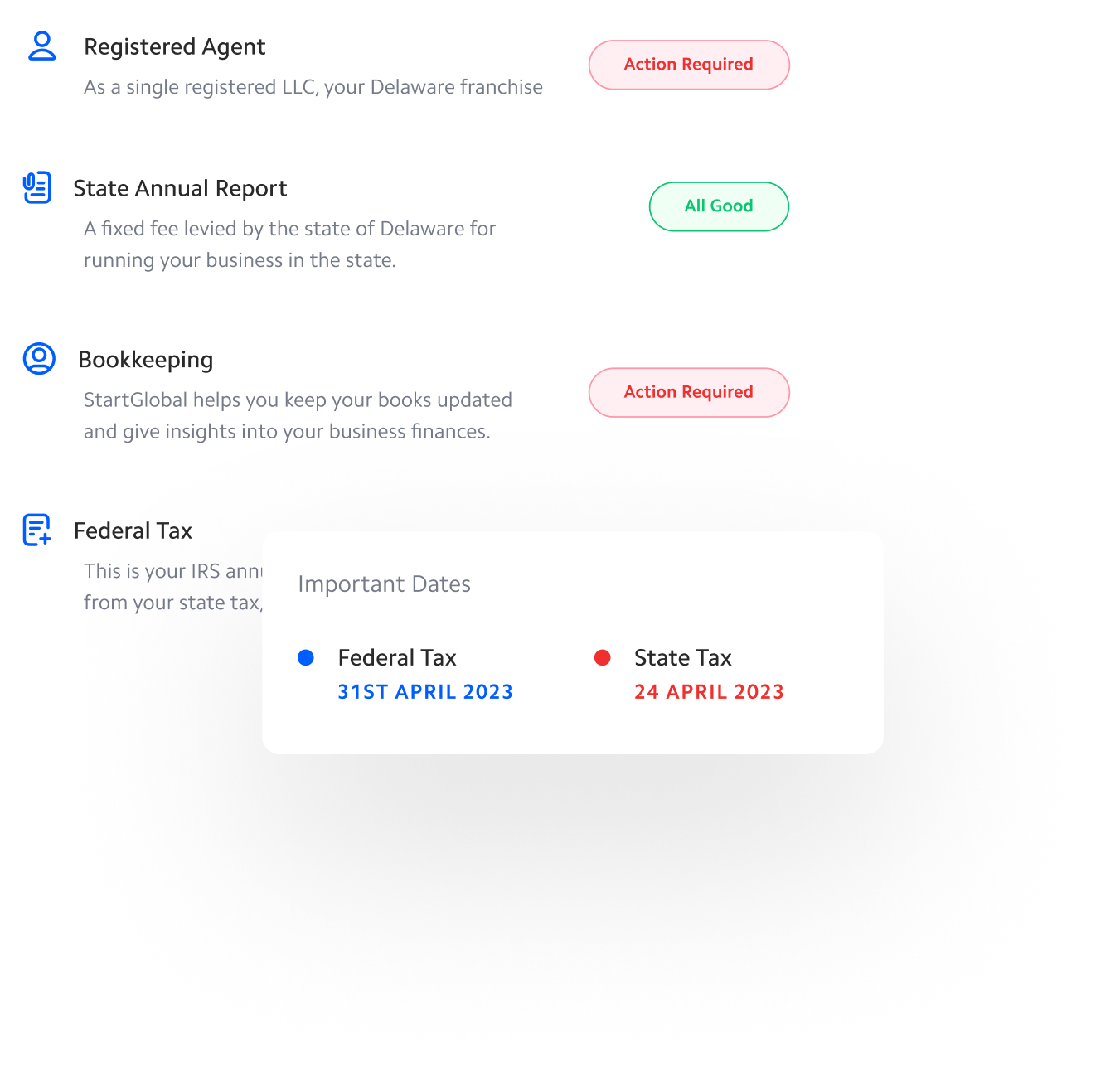

Registered Agent

Registered Agent is a mandatory compliance in the state for your LLC.

Registered Agent is a mandatory compliance in the state for your LLC.

Annual Reports are to be submitted in the state where you operate your business in.

Franchise Tax is a fee you pay to the state for the right to run your business in the state.

DeltaHub will assist you with any e-filing or faxes whenever required.

You'll never miss another filing with DeltaHub. We'll notify you over email, WhatsApp and Calls whenever possible. You can also get a comprehensive view of your compliances on your dashboard.

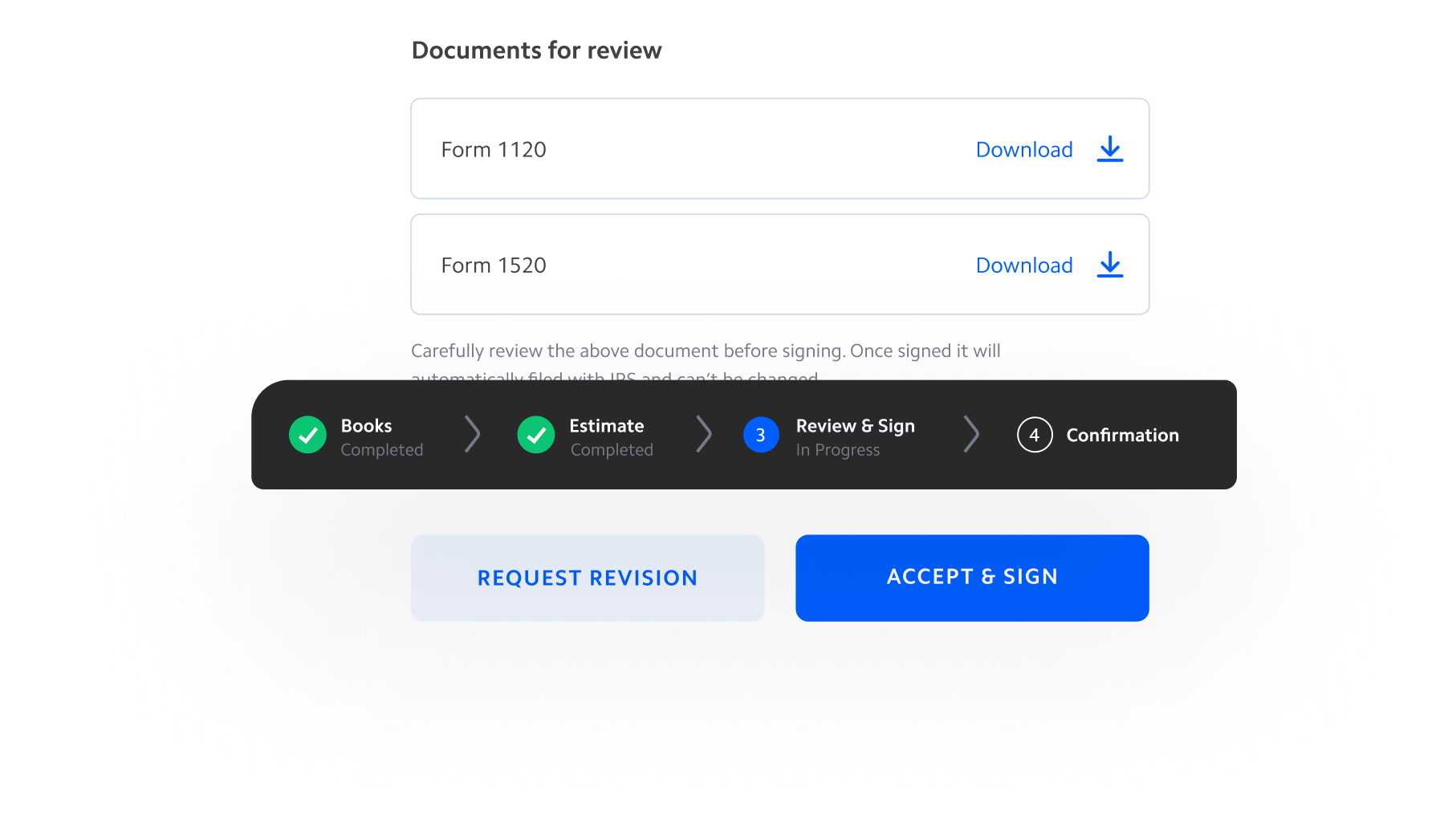

Get a slick experience of filling out forms, updating data, and providing digital signatures, all in one flow. Our dashboard brings everything to you in one intuitive interface.

Setup a new LLC from scratch with DeltaHub.

Migrate an existing LLC to DeltaHub.

All your State compliances in one place. We handle everything from Registered Agents to Annual Report and Franchise Taxes.

Ultimate bookkeeping and accounting software built-in the platform. Never worry about your books again.

Get professional help to stay compliant and manage all your taxes in one place. All your IRS Filings are done by our tax expert.